- Article Category

- IRS Form 5471

- Published on

Subpart F Income in a Multi-Level Structure, Episode 2

Phil Hodgen

Attorney, Principal

Share

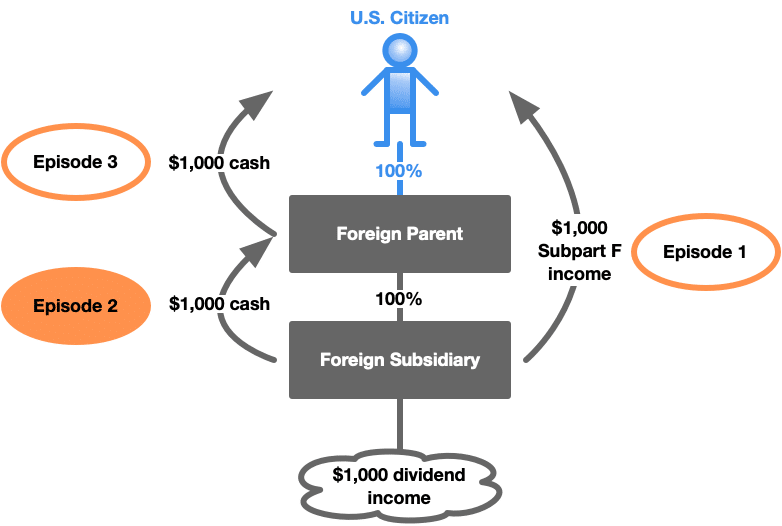

What happens when a subsidiary CFC pays a dividend to its parent CFC? Does that create subpart F income for the U.S. shareholder of the parent CFC?!

I am tracing $1,000 of generic dividend income received (from Nestlé) by Foreign Subsidiary as it is distributed upstream to eventually land in U.S. Citizen's pocket. The end result is $1,000 of subpart F income on U.S. Citizen's Form 1040 to match the $1,000 in his pocket. But the tax logic is a bit convoluted to get to that commonsense result.

In Episode 1 I showed how a lower-tier CFC’s subpart F income skips all intervening levels in a holding structure and goes straight to the United States shareholder’s gross income.

Today, I will show how a $1,000 dividend from Foreign Subsidiary to Foreign Parent will not create subpart F income for Foreign Parent. In two weeks, I will wrap up the analysis when Foreign Parent pays a dividend to U.S. Citizen.

The dividend from Foreign Subsidiary creates gross income for Foreign Parent

Foreign Parent has gross income (in the form of dividend income) when it receives a distribution from Foreign Subsidiary. Obvious, but here’s why:

A dividend (defined in IRC §316) is included in gross income of a shareholder receiving a distribution from a corporation. IRC §301(c)(1).

A dividend is a distribution to a shareholder out of the corporation’s current and accumulated earnings and profits. IRC §316(a).

Foreign Subsidiary received $1,000 of dividend income from Nestlé in my example from Episode 1, so has $1,000 of earnings and profits.

Foreign Subsidiary distributes $1,000 to Foreign Parent, so the entire distribution is from Foreign Subsidiary’s earnings and profits – making this dividend income for Foreign Parent.

This, unless corrected, creates subpart F income for Foreign Parent . . .

Foreign Parent’s $1,000 of dividend income is classified as subpart F income:

- Foreign Parent received a dividend from Foreign Subsidiary.

- Dividend income is classified as Foreign Personal Holding Company Income. IRC §954(c)(1)(A).

- Foreign Personal Holding Company Income is a component of Foreign Base Company Income. IRC §954(a)(1).

- Foreign Base Company Income is a component of subpart F income. IRC §952(a)(2).

Therefore, Foreign Parent’s $1,000 of gross income is tagged as corporate-level subpart F income. This creates a potential problem for U.S. Citizen, as you will see.

. . . which will be included in the U.S. shareholder’s gross income

Subpart F income of a controlled foreign corporation is included in a U.S. shareholder’s gross income. IRC §951(a)(1)(A).

Thus, just because Foreign Subsidiary paid a $1,000 dividend to Foreign Parent, U.S. Citizen has includes Foreign Parent's $1,000 of subpart F income in his gross income.

Oops! $1,000 of Nestlé dividend income for creates $2,000 of taxable income for U.S. Citizen

This is bad.

Look at reality, where real money lives:

- Foreign Subsidiary received a real money $1,000 dividend payment from Nestlé; and

- Foreign Subsidiary paid that $1,000 in real money to Foreign Parent.

Only $1,000 of cash exists.

Then look at the income tax result:

- U.S. Citizen must include $1,000 of subpart F income in gross income from Foreign Subsidiary (see Episode 1); and

- U.S. Citizen must include $1,000 of subpart F income in gross income from Foreign Parent.

U.S. Citizen has $2,000 of gross income on Form 1040: twice as much as the Nestlé dividend that caused the gross income inclusions.

How the Code solves the problem: IRC §959(b)

Obviously, this is dumb.

The Internal Revenue Code patches this bug with IRC §959(b), which says “for subpart F income calculations only, this dividend is not gross income.”

IRC §959(b) says (emphasis added):

For purposes of section 951(a), the earnings and profits of a controlled foreign corporation attributable to amounts which are, or have been, included in the gross income of a United States shareholder under section 951(a), shall not, when distributed through a chain of ownership described under section 958(a), be also included in the gross income of another controlled foreign corporation in such chain for purposes of the application of section 951(a) to such other controlled foreign corporation with respect to such United States shareholder . . . .

Broken down, a clause at a time, here is what happens.

For purposes of section 951(a) . . .

The rule you are about to apply is only for purposes of income inclusion under IRC §951(a). It does not affect anything else. Compute Foreign Parent’s gross income using normal methodology, for instance.

. . . the earnings and profits of a controlled foreign corporation attributable to amounts which are, or have been, included in the gross income of a United States shareholder under section 951(a) . . .

If you look at the distribution from Foreign Subsidiary to Foreign Parent, look at the payor CFC first. Did the distribution come out of earnings and profits of the payor CFC that have already been included in the U.S. shareholder’s gross income as subpart F income (IRC §951(a)(1)(A)) or IRC §956 income (IRC §951(a)(1)(B))? In my little example, yes. U.S. citizen has $1,000 of subpart F income from Foreign Subsidiary’s earnings and profits.

. . . shall not, when distributed through a chain of ownership described under section 958(a),

This clause excludes the distribution only when the distribution of cash is through a chain of ownership described in IRC §958(a). A “chain of ownership” is a multilevel holding structure that has the CFC at the bottom and a stack of foreign entities above, culminating at the top with a U.S. shareholder. IRC §958(a)(2). That’s what exists here: Foreign Subsidiary has a foreign corporation shareholder (Foreign Parent) which in turn has a U.S. shareholder (U.S. Citizen). The “chain of ownership” starts with Foreign Subsidiary and ends with U.S. Citizen. The distribution of $1,000 goes up that chain of ownership.

. . . be also included in the gross income of another controlled foreign corporation in such chain for purposes of the application of section 951(a) to such other controlled foreign corporation with respect to such United States shareholder . . . .

This is the critical element. That distribution from previously-taxed earnings and profits of Foreign Subsidiary is NOT included in gross income of “another controlled foreign corporation” (meaning Foreign Parent in my example) – but only for the purposes of analyzing the impact of IRC §951(a) on Foreign Parent.

Important distinction:

- Foreign Parent does includes the $1,000 dividend received from Foreign Subsidiary in its gross income (as that concept is generally understood) for financial and tax accounting purposes. This keeps Foreign Parent’s financial statements and earnings and profits calculations looking normal.

- Foreign Parent does not include the $1,000 dividend received from Foreign Subsidiary in its gross income for purposes of computing the subpart F income passed through to the U.S. shareholder. That is the impact of IRC §959(b).

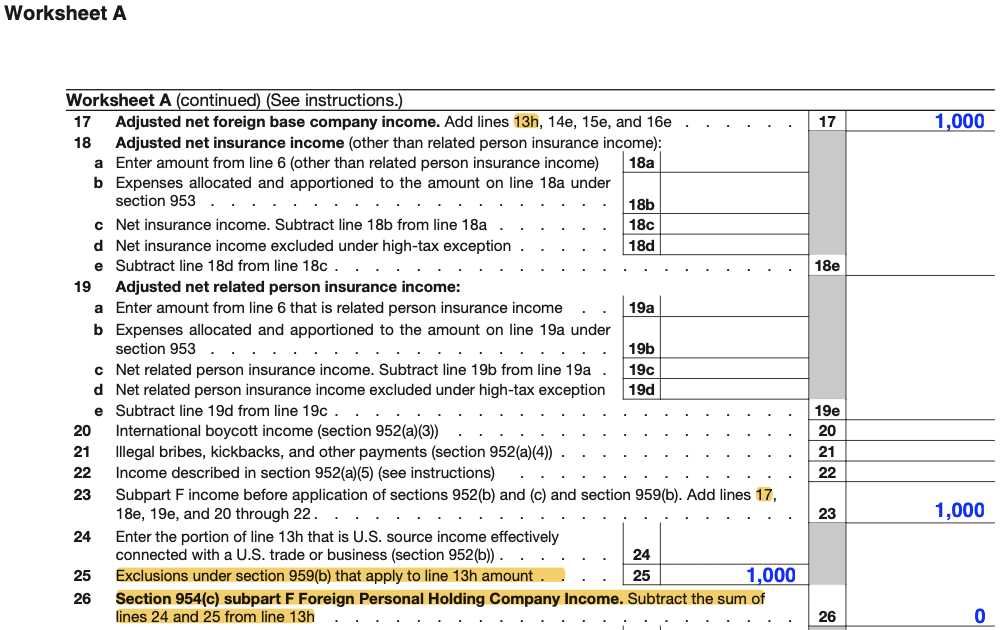

IRC §959(b) in action on Worksheet A

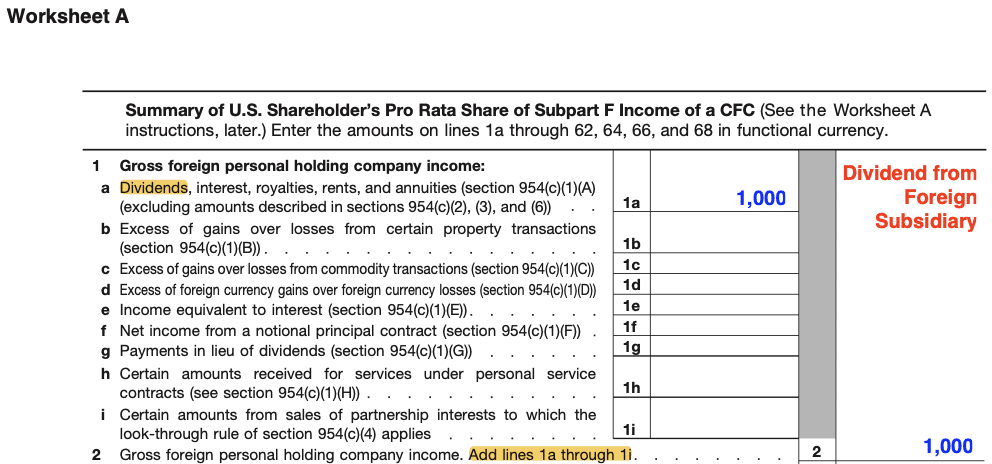

Let’s look at Instructions for Form 5471 (rev. December 2022). Worksheet A gives you the step-by-step method for calculating a U.S. shareholder’s pro rata share of a CFC’s gross income.

First, start computing Foreign Parent’s foreign personal holding company income on line 1a. Include the $1,000 dividend income from Foreign Subsidiary there, and bring the total down to line 2.

Second, remember how foreign personal holding company income is just one of the types of income that makes up Foreign Parent’s foreign base company income? Lines 3 through 12 are where you compute the total base company income.

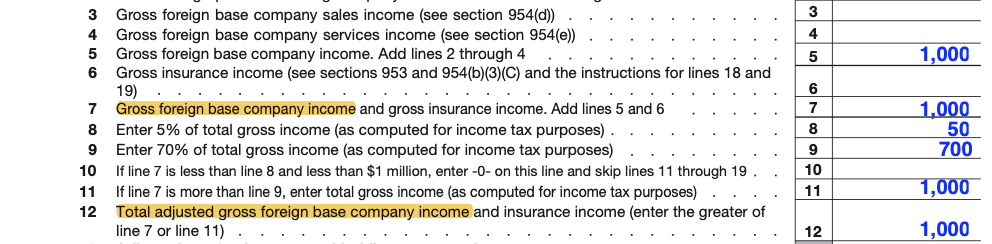

Since the only income that Foreign Parent has is the $1,000 dividend from Foreign Subsidiary, gross foreign base company income (line 7) is $1,000.

Lines 8 through 11 apply the de minimis rule (if a tiny fraction of a CFC’s income is foreign base company income, then none of it is foreign base company income) and the full inclusion rule (if 70% or more of a CFC’s income is foreign base company income, then all of its income is foreign base company income).

Line 12 shows the end result of what happens on lines 8 through 11. This is the “adjusted gross foreign base company income.” (I’m ignoring insurance income throughout this example).

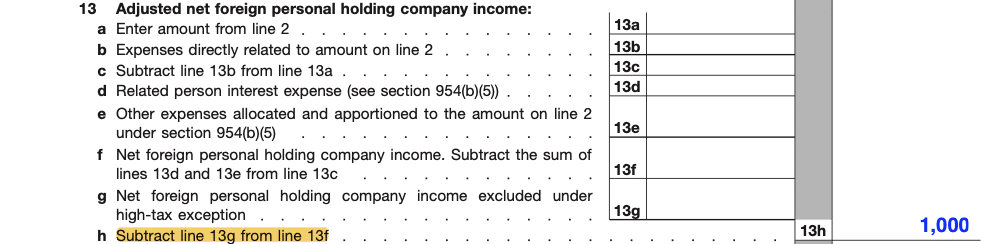

Third, a series of subtractions occur. Subpart F income inclusions are net income, not gross income. Lines 13a - 13g are where the subtractions and exclusions occur to come to net foreign personal holding company company income. Line 13h is the bottom line number that is important to us: “adjusted net foreign personal holding company income.”

(Note: the same type of calculations happen on other lines for other types of foreign base company income. I am only giving you the relevant calculations for my example).

Fourth and finally, we come to the place where the IRC §959(b) exclusion is applied to create a zero subpart F income result for Foreign Parent.

Line 17 is the sum of foreign personal holding company income with other amounts that together comprise foreign base company income. A bunch of irrelevant stuff happens in lines 18 through 22, and a new subtotal is computed on line 23. Again, the only income that Foreign Parent has (so far) is foreign personal holding company income – the $1,000 dividend received from Foreign Subsidiary.

Line 25 is where the IRC §959(b) exclusion is applied. The “line 13h amount” is foreign personal holding company income.

The line 25 exclusion is computed by looking at the payor corporation’s earnings and profits and determining whether the dividend received by Foreign Parent came out of Foreign Subsidiary’s earnings and profits that were included in U.S. Citizen’s gross income “under section 951(a)” (meaning as subpart F income).

The whole $1,000 dividend came from previously-taxed earnings and profits of Foreign Subsidiary. Put $1,000 on line 25.

Line 26 is the includable foreign personal holding company income of Foreign Parent that will be allocated to its U.S. shareholders. Line 26 = Line 13h - (Line 24 + Line 25). This means that Line 26 = $1,000 - $1,000 = $0

Foreign Parent has zero foreign personal holding company income. Since it has no other income of any kind (by assumption), this necessarily means Foreign Parent has zero subpart F income, and therefore U.S. Citizen will have zero subpart F income included in gross income from Foreign Parent.

Symmetry and the music of the celestial spheres

Symmetry between cash income and taxable income has been achieved: $1,000 cash and $1,000 of taxable income.

- $1,000 of cash income came into this holding structure from the outside, in the form of a dividend received from Nestlé by Foreign Subsidiary, then paid upstream to its sole shareholder (Foreign Parent) as a dividend.

- $1,000 of gross income is reported on U.S. Citizen’s income tax return as subpart F income from Foreign Subsidiary, and $0 is included from Foreign Parent.

Next time

The final episode of this series will see Foreign Parent pay a dividend to U.S. Citizen. We will see how the symmetry is maintained in the structure. U.S. Citizen will have only $1,000 of gross income reported on Form 1040, and will have $1,000 of cash in hand so he can go outside and buy a hamburger anytime he feels like it.

This will touch on earnings and profits and basis adjustments in order to maintain the symmetry.