- Article Category

- IRS Form 5471

Updated Posted

Installment 1. Why 5a/5b/5c Exist. And Your Workflow to Figure it Out.

Phil Hodgen

Attorney, Principal

Share

Figuring out Categories 5a/5b/5c, in five installments

I want to help you figure out which box to check (or not!) in Item B of Form 5471— Category 5a, 5b, or 5c.

In the interests of keeping my newsletters relatively brief, I’m going to break it up the lengthy analysis into five separate installments.

- Installment 1: Why? And Your Checklist. If you understand how the IRS tried to fix what Congress broke, the whole exercise of figuring out which (sub)category applies will be a bit easier.

Future installments will deal with help you work through the checklist so you arrive at the right answer:

- Installment 2: Foreign-Controlled CFCs. Is your foreign corporation a “foreign-controlled CFC” or a “U.S.-controlled CFC” and why does this matter? (Hint: U.S.-controlled CFCs go straight to Category 5a.)

- Installment 3: Related or Unrelated? Is your United States shareholder “related” or “unrelated” to the foreign-controlled controlled CFC?

- Installment 4: What Kind of Shareholder? Is your United States shareholder a “section 958(a) U.S. shareholder” or a “constructive U.S. shareholder”?

- Installment 5: Checking the Right Box. We pull it all together. You will know whether your United States shareholder is a Category 5a, 5b, or 5c filer, or maybe you hit the jackpot—and the Category 5 filing requirement is waived entirely.

What caused this mess?

Congress tried to empty the water out of a leaky boat (stop a certain type of tax avoidance transaction) by drilling a hole in the hull to let the water out (by repealing IRC §958(b)(4)).

Second-order effects, people. Second-order effects.

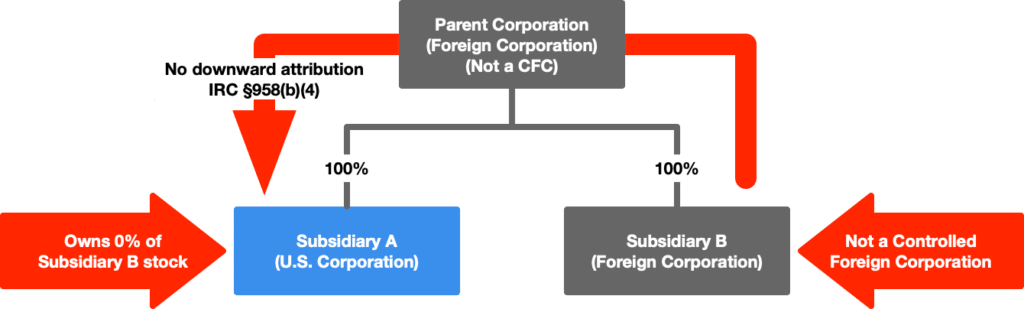

Before 2017: IRC §318(a)(3)(C) + IRC §958(b)(4) = answer

Before 2017’s Tax Cuts and Jobs Act, downward attribution of stock ownership from a foreign person to a United States entity could not happen.

A United States person’s stock ownership in a foreign corporation was determined by the general principles of IRC §318(a), as modified by IRC §958(b)(1) through (4).

Downward attribution of stock ownership (to an entity from its owner) happens because of IRC §318(a)(3). This discussion looks at downward attribution from a foreign person to a United States corporation, which is described in IRC §318(a)(3)(c). The same principles will cause attribution of foreign corporation stock to a domestic partnership, trust, or estate.

IRC §318(a)(3)(C) states the general rule: downward attribution of stock from a shareholder to a corporation occurs if the shareholder owns 50% or more of the corporation’s stock.

If 50 percent or more in value of the stock in a corporation is owned, directly or indirectly, by or for any person, such corporation shall be considered as owning the stock owned, directly or indirectly, by or for such person.

But IRC §958(b)(4) (now repealed) said that downward attribution to a domestic corporation does not occur if its 50%+ shareholder is a foreign person. IRC §958(b)(4) said:

Subparagraph (A), (B), and (C) of section 318(a)(3) shall not be applied so as to consider a United States person as owning stock which is owned by a person who is not a United States person.

Before 2017: example

Here is an example of how things worked before repeal of IRC §958(b)(4):

No downward attribution would occur in this example, before the Tax Cuts and Jobs Act.

- Parent Corporation owns 100% of Subsidiary A stock.

- Downward attribution did not occur because of IRC §958(b)(4) modified IRC §318(a)(3)(C) to prevent downward attribution of Subsidiary B stock to Subsidiary A, because Parent Corporation is a "foreign person."

- Therefore, Subsidiary A is not a United States shareholder of Subsidiary B because it owned no stock of Subsidiary B, directly, indirectly, or constructively.

- As a result, Subsidiary A did not have a Category 5 filing requirement, because only United States shareholders have a Category 5 filing requirement.

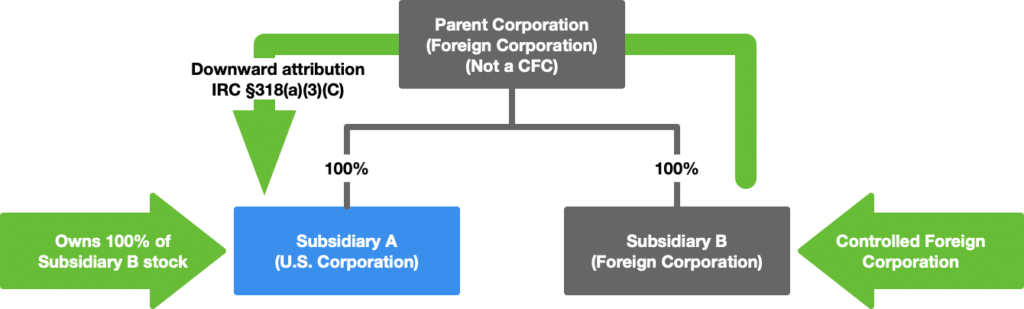

After 2017: IRC §318(a)(3)(C) = answer

With the repeal of IRC §958(b)(4) in late 2017, the standard downward attribution rule of IRC §318(a)(3)(C) now fully applies, without modification:

If 50 percent or more in value of the stock in a corporation is owned, directly or indirectly, by or for any person, such corporation shall be considered as owning the stock owned, directly or indirectly, by or for such person.

Ever since the Tax Cuts and Jobs Act, downward attribution from foreign persons to domestic entities is permitted.

After 2017: example

All of Subsidiary B’s stock owned by Parent Corporation is now considered as owned by Subsidiary A.

IRC §318(a)(3)(C) says that Subsidiary A will be considered to be the owner of Subsidiary B stock owned by Parent Corporation. Since Parent Corporation owns 100% of Subsidiary B stock, the following collateral damage is caused:

- Subsidiary A is a United States shareholder of Subsidiary B because it constructively owns 100% of Subsidiary B's stock. IRC §951(b).

- Subsidiary B is a controlled foreign corporation because United States shareholders own more than 50% of its stock. IRC §957(a).

- And as a result, Subsidiary A is a Category 5 filer of Form 5471 as to Subsidiary B. IRC §6038(a)(4).

After 2017: more filing burdens and inability to get data

The real world consequence of the new way of life (downward attribution is now allowed from foreign persons to United States persons) is:

- More United States persons are United States shareholders and more foreign corporations are controlled foreign corporations;

- Which meant that more people have Category 5 filing requirements; and

- In many cases they cannot get the information needed to complete Form 5471.

The IRS noted in Rev. Proc. 2019-40, Section 2 (emphasis added):

The Treasury Department and the IRS are aware that, in certain circumstances, taxpayers are required to include in gross income amounts under sections 951 ("subpart F inclusion amounts") and 951A ("GILTI inclusion amounts") attributable to, and report amounts with respect to, foreign corporations that are CFCs solely because of the repeal of section 958(b)(4), even though those taxpayers may have limited ability to determine whether such foreign corporations are CFCs and to obtain the information necessary to accurately determine these amounts.

How Rev. Proc. 2019-40 cleaned up the mess

To minimize the unpleasantries, the IRS provided (some) relief for potential Form 5471 filers in Notice 2018-13 and (mostly) in Rev. Proc. 2019-40. The administrative relief will in some cases eliminate the Form 5471 filing obligation entirely, and in others will reduce the information required to be reported.

Rev. Proc. 2019-40, Section 8 is where you look for the relaxed filing requirements. The Instructions for Form 5471 named the different outcomes as Categories 5a, 5b, and 5c.

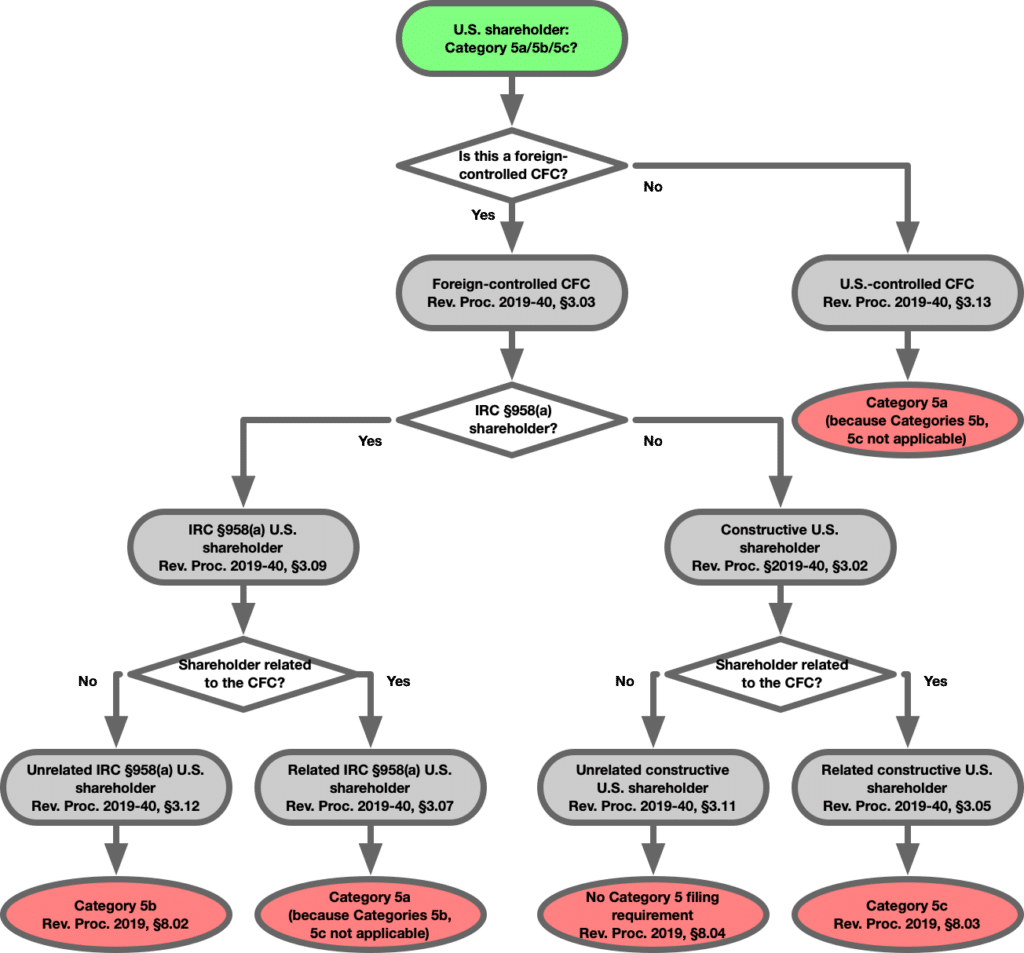

How to apply Rev. Proc. 2019-40: your workflow

This is the workflow to follow for determining which of the three Category 5 checkboxes will apply to your United States shareholder.

What you’ve already done to get here

If you are trying to figure out which of the 5a, 5b, or 5c boxes you should check at Item B, you have already done some work.

- United States shareholder status established. You will have previously established that your taxpayer is a United States shareholder as defined in IRC §951(b).

- Controlled foreign corporation status established. You will also have established that the foreign corporation is a controlled foreign corporation, as defined in IRC §957(a).

- Category 5 filing status established. You have correctly determined that because you have a United States shareholder of a controlled foreign corporation, you have a Category 5 problem. IRC §6038(a)(4).

What you do now

We are going to determine which of the three Category 5 categories applies. (Yes, the Instructions for Form 5471 confusingly call Category 5a, 5b, and 5c “categories” instead of subcategories, which is what they really are.)

- Foreign-controlled CFC status determined. If the foreign corporation is a controlled foreign corporation solely because of the repeal of IRC §958(b)(4), you have hope: the shareholder may qualify for Category 5b or Category 5c, which means fewer Schedules are attached to Form 5471. You might even get lucky and have the Category 5 filing obligation waived entirely.

- Type of share ownership established. The selection of the correct category will depend on whether the United States shareholder is a direct or indirect shareholder in the controlled foreign corporation (IRC §958(a)) or is a constructive shareholder (IRC §958(b)).

- Shareholder-corporation relationship established. Finally, is the United States shareholder “related” to the controlled foreign corporation? If yes, the implication is that it is easier for the United States shareholder to acquire the data necessary to complete Form 5471, and therefore the government doesn't cut you so much slack.

Flowchart

Your previous work means you are at the green pill-shape at the top of the flow chart.

The diamond shapes in the flow chart show you the questions you must analyze. The grey pill-shapes are the only possible answers to the questions. Red ovals contain the result of your analysis and tell you which box to check in Item B of Form 5471.

Here is your workflow, in glorious flowchart. In future installments I will dive deep into each step of the analysis.

The Matrix of Outcomes

Here is the ubiquitous 2x2 matrix which works for everything.

| The U.S. person . . . | Has direct or indirect stock ownership via IRC §958(a) in a foreign-controlled CFC | Has only constructive stock ownership through a foreign person via IRC §§958(b), 318(a)(3)(C) |

|---|---|---|

| Is “related” to the foreign-controlled CFC | Category 5a | Category 5c |

| Is “unrelated” to the foreign-controlled CFC | Category 5b | No Form 5471 filing requirement |

In the next part, we start with the first question in the workflow. How do you determine whether a controlled foreign corporation is a “foreign-controlled” CFC? And what are the consequences of deciding that the CFC is foreign-controlled—or isn’t?