- Article Categories

- Cross Border Business, IRS Form 5471

- Published on

Form 5471 Category 1 Rarely Applies, and Never* for a New U.S. Resident

Phil Hodgen

Attorney, Principal

Share

Typical scenario

A nonresident owns 100% of a foreign corporation’s stock. Neither the shareholder nor the foreign corporation have any contact with the United States in the years before the nonresident comes to the United States.

The nonresident commences resident alien in calendar year 2023.

The foreign corporation is classified as a controlled foreign corporation and the individual is a U.S. shareholder. A 2023 Form 5471 is required and you’ll check the boxes for Categories 2 through 5, undoubtedly.

But not Category 1.

Immigrants will never be Category 1 filer

“I have to check a Category 1 box, right?”

This question especially comes up in the first year of filing Form 1040 for a new U.S. resident taxpayer. And the answer is almost invariably “No.”

But why? You have a taxpayer preparing that first-year U.S. income tax return and there is a Form 5471 involved. Why is it impossible for Category 1 to apply?

The short attention-span explanation

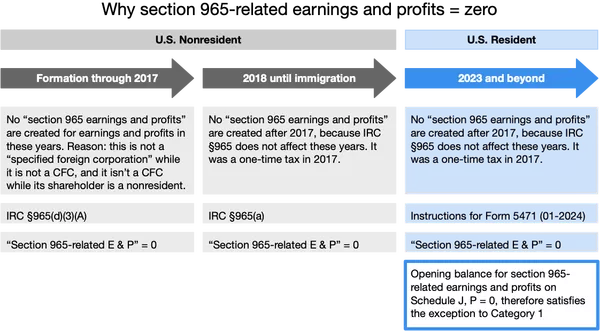

It looks at first glance like there is a filing requirement. But a filing exception applies, so Category 1 filing is waived. The reason: it is impossible for the foreign corporation to have the right type of earnings and profits to trigger the filing requirement.

Category 1 filing is required . . .

The Instructions for Form 5471 (2023) make it clear that the new U.S. resident is a Category 1 filer in the first year of residency.

Two ingredients required. Both exist.

- You need a U.S. shareholder of a foreign corporation. We have that by assumption.

- You need a “section 965 specified foreign corporation.” All CFCs are specified foreign corporations. IRC §965(e)(1)(A). (There is another way a foreign corporation can be a specified foreign corporation, but let’s ignore that). Now that the shareholder is a U.S. resident, he is a U.S. shareholder and the corporation is a CFC.

Fun fact: adding “section 965” in front of the defined term “specified foreign corporation” is necessary because IRC §898 also uses “specified foreign corporation.”

. . . but an exception applies

The Instructions for Form 5471 (rev. 01-2024) give a filing exception for Category 1. If the foreign corporation’s earnings and profits are completely devoid of IRC §965-tainted earnings and profits, then the Category 1 filing requirement ends.

Oh joy. Earnings and profits.

Section 965-related earnings and profits will always start at zero for an immigrant

It is impossible for a foreign corporation to ever have any accumulated “earnings and profits related to IRC §965” on Schedule J for the years prior to the shareholder becoming a U.S. resident.

For all of the foreign corporation’s history through 2017, IRC §965(a) looks for post-1986 untaxed earnings and profits attributable to a U.S. shareholder. These earnings and profits were the base for calculating the transition tax.

For a new U.S. resident’s foreign corporation, there were no U.S. shareholders in that timeframe. Therefore, IRC §965 had no interest in taxing those earnings and profits–they were attributable to a foreign shareholder who was not a U.S. taxpayer.

So those earnings and profits (from 1987 through 2017) are not part of the bucket of earnings and profits scooped up and poured into IRC §965(a) to become subpart F income. And this is done by a simple mechanism: if the foreign corporation was a specified foreign corporation in that time frame, it must have had U.S. shareholders. Include the earnings and profits. If the foreign corporation was not a specified foreign corporation the 1987 through 2017 time frame, it must not have had U.S. shareholders. Exclude the earnings and profits.

From 2018 until the day before the shareholder’s commencement of U.S. residency, IRC §965 creates no new earnings and profits. It was just a one-time tax in 2017. So during those years it is easy to say that there are not accumulated earnings and profits that are related to section 965 (from 2017) and no new earnings and profits generated in later years.

Section 965-related earnings and profits are still zero.

Then in my example, in 2023 the shareholder becomes a U.S. resident. Form 5471, Schedule J asks for opening balances for the various earnings and profits buckets, including the buckets for section 965-related earnings and profits. All are zero.

Now look at the filing exception: the Category 1 filing requirement continues until section 965-related earnings and profits on Schedule J (and Schedule P) are zero. Which they are, on the first day of U.S. residency.

Therefore, the filing exception applies.

Category 1, as a practical matter

Here’s a quick little algorithm for you to follow to identify knockout punches (Category 1 cannot apply) so you quickly decide whether you need to think about Category 1.

- If the corporation did not exist in 2017, it is impossible for Category 1 to apply.

- If the corporation was never a “specified foreign corporation” from 1987 to 2017, it is impossible for Category 1 to apply.

If you read this far, thank you. IRC §965 is ancient history now (for the most part) for almost everyone. Category 1 should now apply only where U.S. taxpayers elected to pay the transition tax in installments. (Well, U.S. taxpayers who are cleaning up serious messes and need to do some remedial filings make care about Category 1, too).

Eventually, let’s hope that Category 1 becomes useless and is discarded, as it was before the Tax Cut and Jobs Act.