- Article Category

- IRS Form 5471

- Published on

Installment 5 - Choosing and Checking the Right Box: 5a, 5b, or 5c

Phil Hodgen

Attorney, Principal

Share

Hello and welcome to Installment 5 of a 5 part series to help you figure out whether a U.S. shareholder is a Category 5a, 5b, or 5c filer of For 5471.

The series so far

Completed installments:

- Installment 1: Why? And Your Checklist. If you understand how the IRS tried to fix what Congress broke, the whole exercise of figuring out which (sub)category applies will be a bit easier.

- Installment 2: Foreign-Controlled CFCs. Is your foreign corporation a “foreign-controlled CFC” or a “U.S.-controlled CFC” and why does this matter? (Hint: U.S.-controlled CFCs go straight to Category 5a.)

- Installment 3: What Kind of Shareholder? Is your United States shareholder a “section 958(a) U.S. shareholder” or a “constructive U.S. shareholder”?

- Installment 4: Related or Unrelated? Is your United States shareholder “related” or “unrelated” to the foreign-controlled controlled CFC?

This installment:

- Installment 5: Checking the Right Box. We pull it all together. You will know whether your United States shareholder is a Category 5a, 5b, or 5c filer, or maybe you hit the jackpot—and the Category 5 filing requirement is waived entirely.

Monthly Standard Operating Procedures Coming Soon

This is an SOP. Standard Operating Procedure. Everyone I know wants them but nobody has them. I want to fix that.

I am going to publish something like this SOP every month in my (coming soon) paid newsletter.

If you want one Standard Operating Procedure a month, sign up for our free newsletter and watch out for the announcement to sign up for the paid newsletter in the coming weeks.

Standard Operating Procedure for Category 5 Status Determination

Warning about filing exceptions

The following checklist identifies only the filing exceptions in Notice 2018, §5.02 and Rev. Proc. 2019-40, §8.04. If you determine that you have a Category 5a, 5b, or 5c filing requirement, refer to the Instructions for Form 5471 for potentially applicable filing exceptions that may apply to your situation.

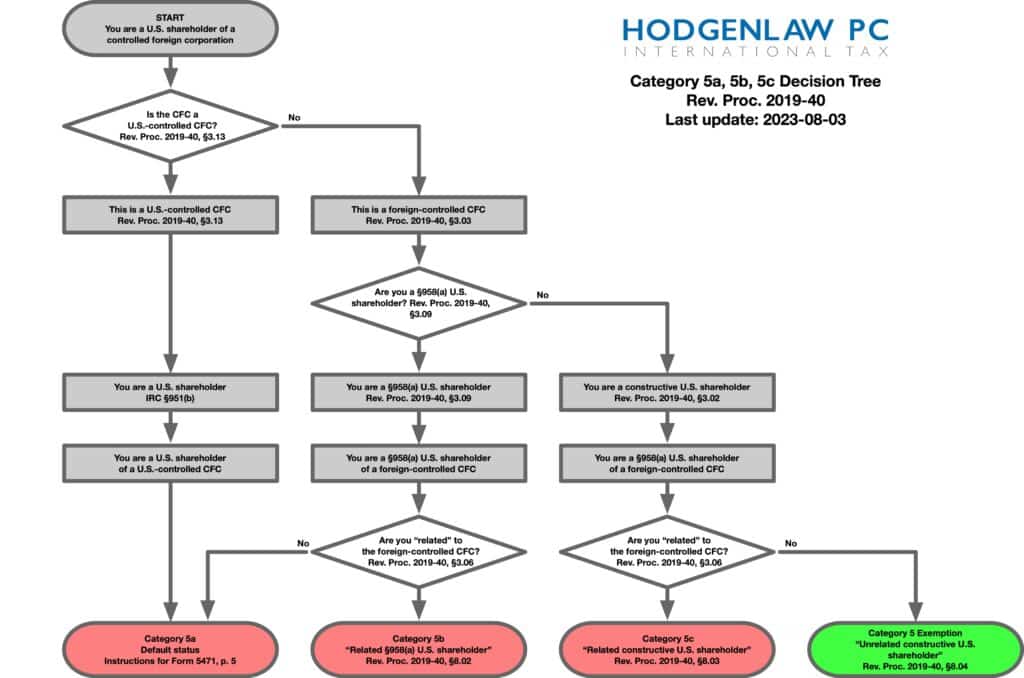

Flowchart

Here is the complete flowchart you can use to understand the analytical process in this Standard Operating Procedure.

Legal authority

- IRC §318(a) - for constructive ownership of stock; its rules are invoked by IRC §958(b). You may need to dive into the Regulations as well.

- IRC §954(d)(3) - for the definition of “related”. Also, Reg. §1.954-1(f) defines “related person” and “control” in great detail. Very useful.

- IRC §951(b) - the definition of “United States shareholder”.

- IRC §957(a) - the definition of “controlled foreign corporation”.

- IRC §958 - how to determine a taxpayer’s ownership of foreign corporation stock.

- IRC §6038(a)(4) - the operative law that grants the IRS authority to ask for any information it wants to get from a United States shareholder of a controlled foreign corporation. This is why Notice 2018-13, Rev. Proc. 2018-40, and the Instructions for Form 5471 are authoritative enough for our purposes.

- IRC §7701(a)(1) - the definition of “person”.

- IRC §7701(a)(3) - the definition of “corporation”. you probably also need to look at the check-the-box regulations to determine the classification of your foreign entity as (you hope) a corporation. See Regs. §301.7701-1 through -3. Pay particular attention to Reg. §301.7701-2(b)(8)(i), for the definition of a per se corporation. Also especially look at Reg. §301.7701-3(b)(2), which tells you how a foreign entity is classified if it is eligible to make a check-the-box election but hasn’t (yet).

- IRC §7701(a)(5) - the definition of “foreign”.

- IRC §7701(a)(30) - the definition of “United States person” (for purposes of defining a “United States shareholder”).

- Notice 2018-13. The IRS attempts to mitigate the very-much-anticipated but ignored by Congress mal-effects of repeal of IRC §958(b)(4), which opened the floodgates to downward attribution from foreign persons.

- Rev. Proc. 2019-40 - the IRS continues to soften the blow of the repeal of IRC §958(b)(4).

- Instructions for Form 5471 - cogent and well-organized; unfortunately, the explanations are (by necessity) terse.

- Regulations - even if I didn’t mention them explicitly, when you take a look at a Code section also pull up and read the companion Regulations.

The SOP

To maintain formatting and clarity, the SOP can be downloaded below.